Understanding market liquidity and order flow is crucial for modern traders. However, traditional candlestick charts often hide what is really happening beneath the surface. Fortunately, Bookmap solves this problem by visualizing liquidity, volume, and order flow in real time.

In this Bookmap review 2026, we will also analyze features, pricing, pros and cons, supported markets, and who this platform is best suited for.

What Is Bookmap?

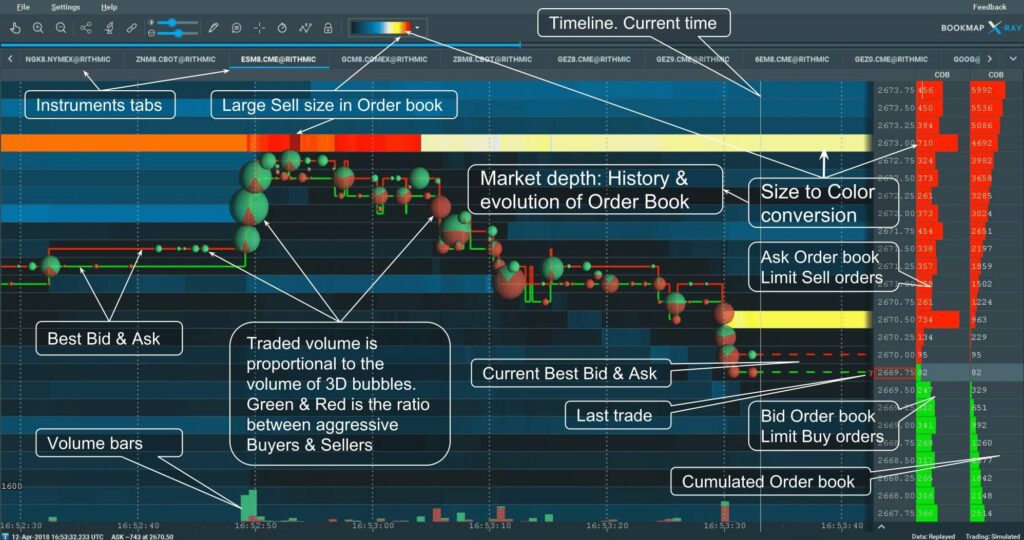

Moreover, Bookmap is an advanced trading platform that provides real-time visualization of market depth, liquidity, and executed volume. Instead of standard price charts, it uses a liquidity heatmap to show where large limit orders are placed and, consequently, how the price reacts to them.

As a result, traders gain insight into supply and demand dynamics that are normally invisible on standard charts.

Bookmap is widely used by:

Futures traders

Day traders

Scalpers

Order flow and volume traders

How Bookmap Works

First, Bookmap connects to your broker or data provider. Then, it displays live order book data directly on the chart.

The platform visualizes:

Resting liquidity (limit orders)

Market orders hitting the bid or ask

Volume intensity at specific price levels

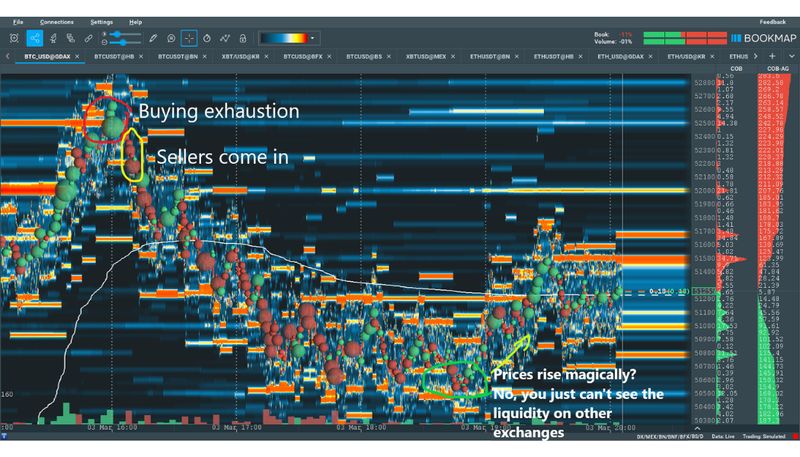

Consequently, traders can anticipate potential support, resistance, and liquidity-driven price reactions.

Key Bookmap Features

Liquidity Heatmap

Most importantly, the heatmap shows where large limit orders are clustered. Brighter colors indicate stronger liquidity, thereby helping traders identify critical price levels.

Volume Bubbles

In addition, volume bubbles display executed trades in real time. This way, traders can distinguish aggressive buying from aggressive selling.

Best Bid & Offer (BBO)

Moreover, this platform tracks best bid and ask changes, which makes it easier to read short-term market pressure.

Replay Mode

For learning and strategy development, Bookmap also offers replay functionality. Traders can analyze past sessions and thus refine execution techniques.

Custom Indicators & API

Advanced users can additionally create custom indicators or connect this order flow tool to external systems using its API.

Supported Markets

Bookmap supports multiple asset classes, including:

Futures (CME, Eurex, etc.)

Stocks (depending on data feed)

Cryptocurrencies (via supported exchanges)

Therefore, it is flexible enough for both traditional and crypto traders.

Bookmap Pricing (2026)

Bookmap offers multiple plans depending on data needs:

| Plan | Description |

|---|---|

| Free (Digital) | Delayed data, limited features |

| Global | Real-time data, core tools |

| Global+ | Advanced tools and premium add-ons |

However, keep in mind that market data fees are often separate and depend on the exchange and broker.

Pros of Bookmap

Deep order flow and liquidity visualization

Unique heatmap technology

Excellent for futures and scalping strategies

Replay mode for learning and backtesting

Widely respected among professional traders

Additionally, its flexibility makes it suitable for both beginners (with free plans) and advanced traders.

Cons of Bookmap

Steep learning curve for beginners

Requires high-quality data feeds

Can be expensive with add-ons and data fees

Not designed for long-term investing

On the other hand, these limitations are mostly relevant for casual traders or beginners.

Bookmap vs Traditional Charting Platforms

Compared to platforms like TradingView or MetaTrader, this order flow tool focuses less on indicators and more on raw market mechanics.

While traditional charts show what happened, the liquidity heatmap software helps traders understand why it happened.

As a result, many advanced traders use this platform alongside other platforms rather than as a replacement.

Who Should Use Bookmap?

Bookmap is ideal if you:

Trade futures or actively day trade

Use order flow or liquidity-based strategies

Want deeper insight into institutional activity

Are willing to invest time in learning

On the other hand, if you are a beginner or long-term investor, the platform may feel overwhelming.

Is Bookmap Worth It in 2026?

Overall, the liquidity heatmap software remains one of the most powerful order flow trading platforms in 2026. Its liquidity heatmap and volume visualization tools provide insights unavailable on standard charts.

Although the learning curve is steep, disciplined traders often find the edge worth the effort.

Final Verdict

Bookmap is not just a charting tool – it is a professional-grade market visualization platform. For serious traders focused on order flow, liquidity, and precision entries, this order flow tool can become an indispensable part of their trading workflow.

Ultimately, Bookmap offers a unique edge for traders who want to see beyond traditional charts and understand market mechanics in real time.